- New Wave

- Posts

- The Disloyalty Premium

The Disloyalty Premium

How brands learned to reward the chase, not the catch

𝑰𝒏 𝑻𝒐𝒅𝒂𝒚'𝒔 𝑾𝒂𝒗𝒆:

💳 When staying loyal costs more than switching

🔄 How brands accidentally rewarded the wrong behavior

🎯 Four industries where leaving pays better than staying

🌊 What this means for retention, acquisition, and the future of loyalty

𝑻𝒉𝒆 𝑺𝒉𝒊𝒇𝒕

You've done it before. Called to cancel your internet, insurance, or phone plan. The second you threaten to leave, suddenly they can offer you a better rate. The deal was always there — they just saved it for the exit conversation.

They could have charged you fairly all along. They chose not to.

I'm calling this shift "The Disloyalty Premium"—when brands reward the chase more than the catch, and consumers learn that switching is smarter than staying.

𝑾𝒉𝒚 𝑵𝒐𝒘?

Three forces converged:

Economic pressure made loyalty unaffordable. Food prices jumped after the pandemic. When groceries cost more, brand loyalty becomes a luxury. Inflation turned deal-hunting from opportunistic to necessary.

Technology made switching effortless. Browser extensions find better prices automatically. Fintech apps open bank accounts in minutes with instant bonuses. Resale platforms let you flip clothes without leaving your couch. The friction that once protected brand loyalty disappeared.

Culture reframed switching as smart. Gen Z grew up with TikTok tutorials on coupon stacking and Reddit communities sharing credit card strategies. Younger consumers don't see themselves as particularly loyal, not because they're flaky, but because it's rational behavior.

𝑬𝒂𝒓𝒍𝒚 𝑺𝒊𝒈𝒏𝒂𝒍𝒔

Credit Card Churn:

Reddit's r/churning community has turned disloyalty into a system. Members share flowcharts showing exactly which credit cards to apply for, when to apply, and how to maximize sign-up bonuses while staying under bank radar. Serious churners report earning tens of thousands annually just by rotating cards. Banks know this happens, but they keep offering bigger bonuses anyway. It's disloyalty as an organized sport, and the infrastructure exists because brands designed it this way.

Food Delivery:

Try to cancel DoorDash, Uber Eats, or Grubhub. Suddenly, offers flood in — big discounts on your next orders, free delivery for a month, credits just for staying. The same platforms that gave you nothing as a weekly user will throw money at you the moment you threaten to leave. Consumers figured this out fast. They rotate between apps monthly, chasing whoever's currently bribing them to return. Odd enough, being disloyal saves you money.

Browser Extensions:

Millions of users have installed tools that actively look for reasons to leave brands mid-purchase. You're shopping one site when a popup appears: "This item is cheaper somewhere else." One click and you've switched. You weren't even hunting for deals — the infrastructure found them and made switching easier than staying. These platforms earn fees when you leave, so they profit from your disloyalty. The tools didn't just enable betrayal; they normalized it.

Resale Platforms:

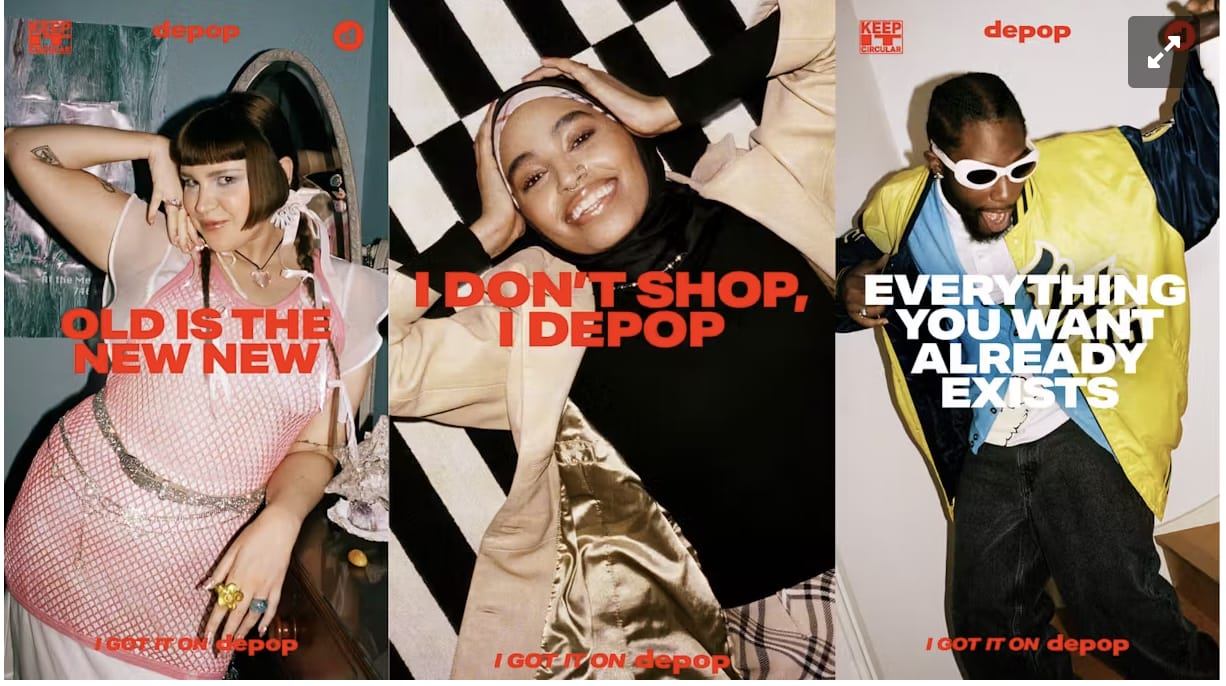

The global secondhand market is growing seven times faster than traditional retail. Gen Z made resale primary, not occasional. When someone identifies clothing by where they bought it rather than who made it, brand loyalty becomes irrelevant. You're not loyal to Nike or Levi's — you're loyal to Depop's interface and Vinted's deals. Some brands launched their own resale programs to fight back, but that just proves the point: they're chasing consumers who already left the primary market.

𝑭𝒖𝒕𝒖𝒓𝒆 𝑰𝒎𝒑𝒍𝒊𝒄𝒂𝒕𝒊𝒐𝒏𝒔

Loyalty means exclusivity, not points. Traditional programs are dying because everyone has them. The average American belongs to multiple loyalty programs but engages with few. The brands that win will offer genuine exclusivity that ‘switchers’ can’t get.

More companies will design for churn instead of fighting it. Netflix offers pause features. ClassPass built around intermittent usage. The question shifts from "how do we prevent churn?" to "how do we make returning easy?" Win-back campaigns will outspend retention because reactivating known customers costs less than acquiring new ones.

Infrastructure monetizes betrayal. Expect more tools profiting from switching. AI that auto-cancels unused subscriptions. Apps alerting you when switching saves money. These platforms make money making you disloyal — and because it's frictionless and financially rewarding, you probably won’t resist it.

𝑸𝒖𝒊𝒄𝒌 𝑻𝒊𝒑𝒔

🔍 Run a loyalty audit this week: Pick your three longest-held subscriptions. Google "[company name] new customer promotion" for each one. If new customers get better deals, call and say you're considering switching. Ask them to match the new customer rate. Most will — they'd rather keep you than lose you.

💳 Set annual review reminders: Add calendar reminders to review insurance, banking, and credit cards. If you've been with the same provider for 2+ years without shopping around, you're likely overpaying.

🔄 Practice strategic switching: Next time you need to buy something, make comparison shopping a habit for big purchases — insurance, phones, subscriptions. The five minutes you spend comparing could save you hundreds.

𝑵𝒆𝒙𝒕 𝑾𝒂𝒗𝒆

See you next week, same time, same place.

If this email was forwarded to you, sign up here.

Stay wavey,

Haley