- New Wave

- Posts

- Community Stake

Community Stake

How brands are turning fans into stakeholders

𝑰𝒏 𝑻𝒐𝒅𝒂𝒚'𝒔 𝑾𝒂𝒗𝒆:

🔑 The evolution from audience collaboration to actual ownership

💰 How giving communities equity creates stronger alignment

🌱 Why old business structures are giving way to shared ownership

🔮 What all this means for creating and sharing value

𝑻𝒉𝒆 𝑺𝒉𝒊𝒇𝒕

Fans aren't just collaborating anymore – they're taking ownership.

In my last newsletter, I explored how audiences are stepping onto the stage as active collaborators rather than passive consumers.

Now, we're witnessing the next evolution: Collective Capital – when communities transform from contributors to actual stakeholders in the ventures they support. The collaborative relationship is maturing into shared ownership.

This isn't just about symbolic belonging. It's about literal equity distribution – financial, governance, and social. The most innovative companies aren't just inviting their communities to co-create products and experiences; they're restructuring their businesses to give those communities actual ownership stakes.

Importantly, with and without tokenization.this isn't exclusively tied to blockchain – many traditional businesses are implementing creative equity structures that achieve similar alignment w

𝑬𝒂𝒓𝒍𝒚 𝑺𝒊𝒈𝒏𝒂𝒍𝒔

Sports: Angel City FC, a women's soccer team in Los Angeles, has pioneered a more inclusive ownership model that moves beyond traditional venture capital. While backed by high-profile investors like Natalie Portman and Serena Williams, what makes their approach revolutionary is their "10% Model" – allocating a significant portion of sponsorship revenue directly to community programs.

This creates a stake for the community even without direct monetary investment from most fans. The model transforms the relationship between team and supporters from passive consumption to meaningful participation, fostering unprecedented engagement and loyalty.

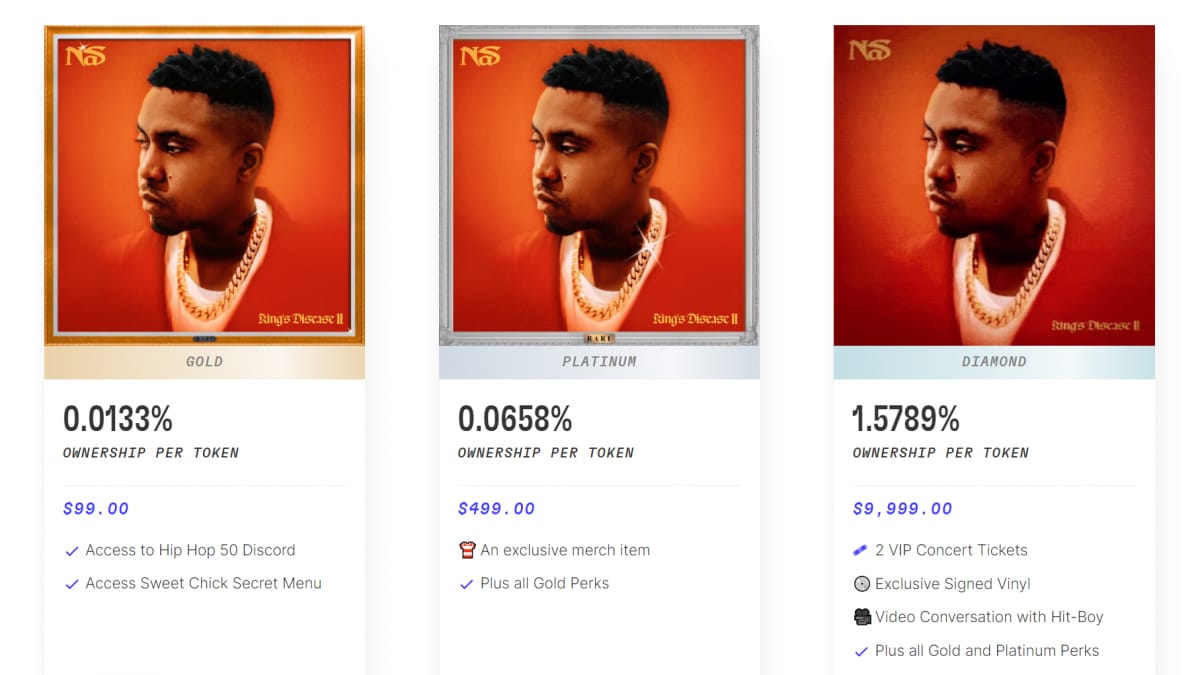

Music: Taking it into the digital realm, Royal.io has transformed how fans interact with music. Founded by DJ Justin "3LAU" Blau in 2021, Royal enables fans to purchase shares of streaming royalty rights as Limited Digital Assets. When Nas partnered with Royal in 2022, fans could invest directly in songs like "Ultra Black" and share in the streaming revenue.

They’re in ‘stealth mode’ right now building the next wave, but they’re one example of a platform that continues to expand its artist partnerships throughout 2024, turning passive listeners into invested partners who benefit financially when the music performs well.

Cultural IP: Similarly, MADE with Black Culture is pioneering ownership in cultural intellectual property. This tech company uses blockchain to certify the ethical trade of Black culture, ensuring creators receive proper recognition and compensation.

By minting cultural IP onto the blockchain, MADE empowers communities to maintain ownership of their creative contributions while enabling transparent, equitable transactions. This transforms the relationship between cultural creators and commercial users from exploitation to partnership.

Visual Arts: Moving from cultural IP to art, Stocksy United has revolutionized stock photography through a cooperative model where photographers don't just contribute their work – they own the platform.

Unlike traditional stock photo services that take the lion's share of revenue, Stocksy distributes 50% of every license directly to the contributing artist and shares annual profits among all member-owners. This ownership structure has attracted top talent and created a distinctive visual library that stands out in a crowded market.

Creator Economy: Lastly, Neptune App is making waves by giving influencers direct equity in their content.

Highlighted on TikTok in December 2024, this emerging platform represents the leading edge of ownership innovation, allowing creators to convert influence into actual ownership stakes – a powerful evolution beyond simple monetization.

𝑾𝒉𝒚 𝑵𝒐𝒘?

Three converging factors make this shift particularly significant:

Value creation demands value sharing. The one-way extraction model where companies capture most of the value while communities receive only products or services is becoming unsustainable. Shared ownership creates a new economic equation where those who help create value receive a proportional stake in the outcome, making compensation more directly connected.

Technology has simplified equity distribution. New tools make it possible to manage thousands of small stakeholders without admin chaos What once required complex legal structures can now be implemented through streamlined digital platforms, making community ownership models viable at scale for the first time.

The talent economy demands alignment. In a world where the best creators and builders have unprecedented options, ownership has become the ultimate alignment mechanism. Companies that don't share equity with their communities risk losing their most valuable contributors to models that do and/or will.

𝑭𝒖𝒕𝒖𝒓𝒆 𝑰𝒎𝒑𝒍𝒊𝒄𝒂𝒕𝒊𝒐𝒏𝒔

Business success will be measured by wealth distribution, not just creation. Companies will be valued not just on how much value they generate but on how effectively they distribute that value among their stakeholders.

Ownership will enable deeper data relationships. When people own a stake in a business, they're more willing to share valuable data, creating a virtuous cycle where better insights lead to better products and more value for all stakeholders.

The lines between consumer, creator, and investor will blur completely. As ownership becomes distributed, traditional role distinctions will dissolve, creating entirely new relationship models between brands and their communities.

Long-term, this shift will fundamentally challenge corporate structures. The limited liability company was designed for a different era. Within the next decade, we'll likely see new legal entities emerge specifically designed to balance community ownership with operational efficiency.

𝑸𝒖𝒊𝒄𝒌 𝑻𝒊𝒑𝒔

🎯 Offer Revenue Share on Specific Projects: Instead of complex equity structures, start by offering a simple revenue share on a single product or content piece. For creators, this might mean giving collaborators 10% of revenue from a co-created course or digital product. For founders, try offering early customers 1% of revenue from products they helped develop. This creates real skin-in-the-game without legal complexity.

🧠 Use Micro-Ownership for Testing: Before a full product launch, release a limited edition where early supporters receive a certificate of ownership that entitles them to a share of that specific product's profits. This creates ownership psychology while limiting your commitment to a defined project rather than your entire business.

🔄 Create Open Decision Points: Identify three key decisions per month that you'll put to a community vote. These could be which feature to prioritize, which content topic to tackle next, or which design direction to pursue. Document the impact of these decisions in monthly updates, showing exactly how community input shapes outcomes. This builds the muscle for more significant ownership later.

𝑾𝒂𝒗𝒆 𝑹𝒖𝒏𝒏𝒆𝒓 𝑪𝒐𝒓𝒏𝒆𝒓

Hit reply and tell me your favorite community stake model! Put me on game as well, I’d love to learn what I should’ve included.

𝑵𝒆𝒙𝒕 𝑾𝒂𝒗𝒆

See you next week, same time, same place.

If this email was forwarded to you, sign up here.

Stay wavey,

Haley